Invest in your Dreams, one Goal at a time

Plan for tomorrow, protect your loved ones today. Goal-based investing meets life insurance for peace of mind and a better life.

UNIT-LINKED PLans

How it Works

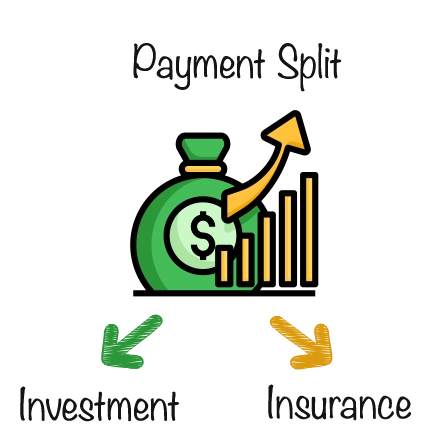

A unit-linked plan (ULP) is a type of financial product that combines investment & insurance. The policyholder pays a premium, which is divided into two parts.

-

1

A portion is used to provide life insurance coverage.

-

2

The remaining amount is invested in units of the chosen funds.

How it works

Our Partners

We are proud to collaborate with a trusted network of partners who play a vital role in delivering value through our Unit Linked Insurance Plans and Money Market Funds.

SELECT A GOAL YOU WOULD LIKE TO ACHIEVE!

Wekapesa Unit Linked Plans

Wekapesa helps you save, grow, and protect your money! Wekapesa Unit Linked Plan (WULP) is the perfect solution to achieve your financial goals—whether you’re buying a home, planning your dream wedding, or starting a business!

Why Wekapesa

Wekapesa offers an extensive and carefully curated range of mutual funds, covering diverse asset classes and sectors.

-

Wide Selection of Funds

Gain instant access to a handpicked selection of top-performing mutual funds across various sectors—carefully curated to suit every financial goal and risk profile.

-

Portfolio Management

Manage and track your entire investment portfolio in one centralized platform with real-time updates and performance insights.

-

Transparent & Affordable

Say goodbye to hidden fees. With zero joining costs and no upfront commissions, WekaPesa keeps investing simple, transparent, and cost-effective.

Frequently Asked Questions

What is a Unit Linked Insurance Plan (ULIP)?

A ULIP is a financial product that combines investment and insurance. A part of your premium provides life insurance coverage, while the rest is invested in market-linked instruments like equities or bon

How does a ULIP work?

When you pay a premium, it is split between life insurance coverage and investment in mutual fund-like options. You can choose how your money is invested based on your risk appetite.

Can I choose how my ULIP investment is allocated?

Yes, ULIPs offer flexibility to invest in equity, debt, or balanced funds. You can also switch between funds to match market conditions or life goals.

What kind of insurance does a ULIP provide?

ULIPs provide life insurance coverage. In the event of the policyholder’s death, the nominee receives either the sum assured, the fund value, or the higher of the two, depending on the plan.

How am I compensated if I survive the policy term?

If you survive the policy term, you receive the fund value—which is the value of your investments at market rates at maturity.

Can I withdraw my money before the policy matures?

Yes, ULIPs allow partial withdrawals of your invested amount (principal and returns) meaning you can withdrwar your principal investment at any time, subject to plan rules.